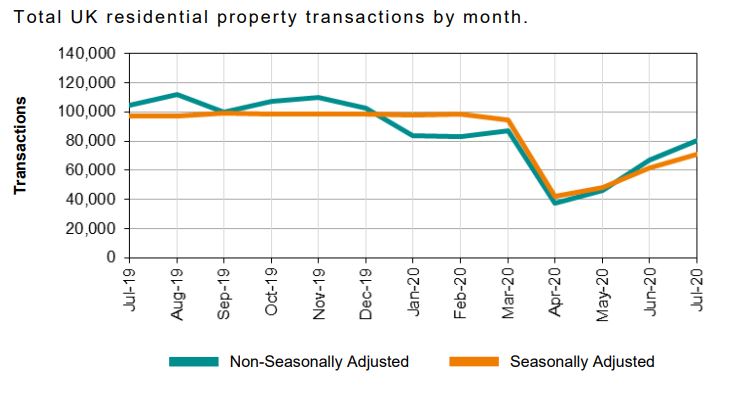

Property transactions are down by a quarter compared with last year as HMRC figures begin to reveal the impact of the coronavirus pandemic on the housing market.

HMRC property transaction data for July 2020 shows it recorded 70,710 provisional residential sales on a seasonally-adjusted basis last month.

This was 27.4% lower than July 2019 but a 14.5% jump from June 2020, suggesting activity has improved since the market reopened in May.

The non-adjusted figure estimated there were 80,490 sales during July, down 23.2% annually but up 20% on a monthly basis.

Commenting on the data, Mark Harris, chief executive of mortgage broker SPF Private Clients, said: “While it’s still too early for the Stamp Duty holiday to feed through to HMRC’s July numbers, transactions continued to pick up owing to pent-up demand.

“Of much more interest will be September’s data when the full impact of the Stamp Duty exemption will be felt and the bustle of activity that we are seeing will feed through to the official numbers.

“Lenders remain keen to lend although they are exceptionally busy due to higher demand, dealing with the summer holidays and other demands placed on them by the fallout from the pandemic, with closer scrutiny of borrowers’ incomes meaning everything is taking longer.

“Rates are still competitively priced although at higher loan-to-values in particular they are creeping up.”

Source: MARC SHOFFMAN